Introduction

Can your current IPTV infrastructure support a 40% subscriber increase without proportional cost inflation? For most IPTV operators, the answer reveals a critical gap between revenue ambition and operational reality. As streaming businesses scale from local deployments to multi-market operations, infrastructure decisions made today determine profit margins for years to come.

The global IPTV market continues its aggressive expansion, projected to exceed $140 billion by 2028, driven by cord-cutting acceleration and enterprise streaming adoption. Yet behind this growth lies intense pressure on operators to deliver broadcast-grade quality while controlling costs and maximizing uptime. The IPTV Encoder Box has emerged as a pivotal component in this equation—not merely as technical infrastructure, but as a strategic asset that directly influences profitability, operational resilience, and competitive positioning.

Unlike cloud-based encoding solutions that shift costs into perpetual operational expenses, or software encoders that compromise on performance predictability, dedicated hardware video encoders represent a calculated investment in long-term business sustainability. This article examines nine profit-boosting advantages that transform how IPTV service providers, resellers, and broadcasters approach return on investment.

Understanding ROI in IPTV Infrastructure

Return on investment in IPTV operations extends far beyond simple capital recovery calculations. True ROI encompasses revenue stability, cost predictability, service quality metrics, and the strategic flexibility to capitalize on market opportunities without infrastructure constraints.

When evaluating an IPTV Encoder Box, decision-makers must consider multiple financial dimensions. Revenue stability depends on consistent stream quality and uptime—factors directly influenced by encoding infrastructure reliability. A single hour of downtime during peak viewing can cost operators thousands in lost subscription revenue, advertising income, and long-term viewer trust. IPTV Encoder Box.

Cost per channel represents another critical ROI metric. As channel portfolios expand from dozens to hundreds of streams, encoding efficiency determines whether growth drives profitability or merely scales operational burden. Hardware encoders with superior video compression efficiency—particularly H.265 / HEVC encoding capabilities—reduce bandwidth costs proportionally across every channel, creating compounding savings as networks grow.

Viewer retention and churn rates tie directly to encoding performance. Buffering events, quality degradation, and synchronization issues during live IPTV streaming sessions push subscribers toward competitors. Industry research indicates that 60% of viewers abandon streams after encountering quality problems, with 40% never returning. The encoder’s role in preventing these revenue-destroying moments cannot be overstated.

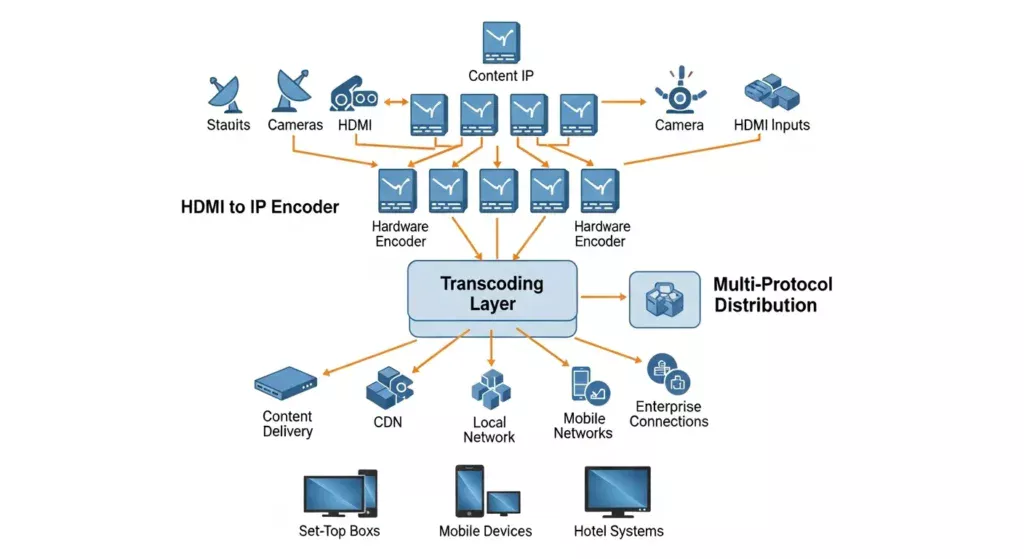

Strategic ROI also includes market positioning flexibility. An IPTV encoder box that supports multiple output protocols—RTMP streaming, UDP multicast streaming, HLS, and MPEG-DASH—enables operators to enter new market segments without replacing core infrastructure. This adaptability transforms the encoder from a single-purpose tool into a platform for business model evolution.

Capital vs Operational Cost Advantages of an IPTV Encoder Box

The financial structure of encoding infrastructure fundamentally shapes IPTV business economics. Cloud-based and software encoding solutions typically operate on subscription or usage-based pricing models, creating perpetual operational expenses that scale with channel count and viewing hours. While these approaches minimize upfront investment, they transfer cost control to external vendors and expose operators to price increases over time.

Dedicated hardware video encoders follow a capital expenditure model. The initial investment typically ranges from $2,000 to $15,000 per unit depending on channel density and encoding capabilities. For a mid-sized operator running 50 channels, the break-even point against cloud encoding subscriptions often occurs within 18 to 24 months.

Consider a five-year ownership analysis. Cloud encoding at $50 per channel monthly generates $30,000 annual expense for 50 channels—totaling $150,000 over five years. A hardware IPTV headend architecture using broadcast-grade encoding hardware might require $40,000 in initial capital but incurs minimal recurring costs beyond power consumption and occasional maintenance. The net savings exceed $100,000, representing capital that can be redirected toward content acquisition, marketing, or network expansion.

Licensing and maintenance present additional considerations. Cloud platforms often bundle support costs into subscriptions, but these fees persist indefinitely. Hardware encoder maintenance typically involves firmware updates and occasional component replacement—predictable costs that decrease as a percentage of revenue as the subscriber base grows.

Depreciation planning favors hardware assets. IPTV encoder boxes can be depreciated over three to five years, providing tax advantages that improve effective ROI. Technology refresh cycles align with business growth phases, allowing operators to upgrade capacity and capabilities when revenue justifies investment rather than being locked into vendor upgrade schedules.

The operational flexibility of owned hardware also protects against vendor pricing volatility. Cloud encoding providers have demonstrated willingness to increase prices by 15-30% annually as streaming demand intensifies. Hardware ownership insulates operators from these external cost pressures, creating budgetary predictability that facilitates long-term business planning.

Latency Economics: How Faster Encoding Improves Monetization

Encoding latency—the delay between video input and stream output—carries direct financial consequences that many operators underestimate. In live IPTV streaming scenarios, particularly sports broadcasting and real-time interactive content, every second of latency erodes viewer engagement and revenue potential.

Live sports represent the highest-stakes latency scenario. Viewers expect broadcast synchronization with event timelines, and delays create opportunity for social media spoilers that diminish viewing experience value. More critically, sports betting integrations—a rapidly growing IPTV monetization channel—require sub-two-second latency to enable in-play wagering. Each additional second of delay excludes operators from this lucrative revenue stream.

An IPTV Encoder Box optimized for low-latency performance typically achieves glass-to-glass latency of 1-3 seconds using hardware acceleration for H.264 encoder and HEVC encoding processes. Cloud encoding solutions, constrained by internet transit time and processing queues, often deliver 6-12 second latency. This performance gap translates directly into monetization capability differences.

Advertising timing represents another latency-sensitive revenue factor. Programmatic ad insertion requires precise synchronization between content and commercial breaks. Excessive encoding latency causes ad misalignment, reducing completion rates and advertiser satisfaction. Industry data suggests that each second of ad timing error reduces completion rates by 8-12%, directly impacting CPM rates and total advertising revenue.

Viewer engagement metrics correlate strongly with perceived responsiveness. Interactive features—chat integration, live polling, synchronized second-screen experiences—all depend on minimal latency. These engagement tools drive subscription premium pricing and differentiate IPTV services in competitive markets. Hardware encoders enable these features; excessive cloud latency often makes them impractical.

The economic calculation becomes clear: a $5,000 investment in a low-latency HDMI to IP encoder enables monetization channels worth thousands monthly. Betting integration commissions, premium interactive subscriptions, and improved advertising performance collectively generate returns that dwarf the initial capital requirement within the first year of operation.

IPTV Encoder Box Reliability and Downtime Risk Reduction

Uptime represents revenue in IPTV operations. Every minute of service interruption translates directly into lost subscription value, missed advertising impressions, and damaged customer relationships. The reliability characteristics of encoding infrastructure determine whether operators achieve enterprise-grade service levels or suffer financially devastating outages.

Hardware video encoders offer inherent stability advantages. Dedicated processing hardware operates in controlled thermal environments with purpose-built components designed for continuous operation. Quality broadcast-grade encoding units routinely achieve 99.9% uptime—approximately 8.7 hours of downtime annually. This reliability protects revenue streams and maintains the service level agreements that enterprise IPTV customers demand.

Cloud encoding introduces dependency risks that operators cannot directly control. Internet connectivity disruptions, cloud provider infrastructure failures, and DDoS attacks all create vulnerability points outside the operator’s infrastructure perimeter. While cloud platforms offer redundancy, recovery time during incidents often exceeds the tolerance thresholds for live IPTV streaming applications. IPTV Encoder Box.

The financial impact of downtime escalates with subscriber base size. An operator serving 10,000 subscribers at $30 monthly generates $10,000 daily revenue. A four-hour prime-time outage costs approximately $1,700 in proportional subscription value, plus immeasurable damage to customer satisfaction and retention. If the incident triggers even 2% subscriber churn, the long-term revenue loss exceeds $72,000 annually.

Hardware encoder reliability also reduces operational stress and emergency response costs. On-premises equipment enables immediate physical troubleshooting and faster incident resolution. Technical teams can diagnose issues, swap components, or activate backup systems within minutes rather than waiting for remote vendor support that may span time zones and support tier escalation processes.

Risk mitigation extends beyond technical uptime to business continuity. Operators maintaining physical control over encoding infrastructure retain service capability even during vendor business disruptions, payment processing issues, or contractual disputes. This independence represents valuable insurance against operational risks that could otherwise halt revenue generation entirely. IPTV Encoder Box.

The ROI calculation for reliability-focused encoder investment becomes straightforward: preventing a single major outage annually justifies premium hardware costs. When downtime protection is valued not just in immediate revenue loss but in customer lifetime value preservation, the business case for dependable IPTV Encoder Box hardware strengthens considerably.

Multi-Format Output Power and Market Expansion

Revenue growth often depends on market diversification—expanding into new subscriber segments, geographic regions, or service models. The multi-format output capabilities of advanced IPTV encoder boxes directly enable this expansion without requiring parallel infrastructure investments or complete system redesign.

Device diversity represents the most immediate expansion opportunity. Modern viewing audiences consume content across smartphones, tablets, smart TVs, set-top boxes, and web browsers—each potentially requiring different streaming protocols and format specifications. An encoder supporting simultaneous RTMP streaming, HLS, MPEG-DASH, and UDP multicast delivery enables operators to serve all device categories from a single encoding infrastructure investment. IPTV Encoder Box.

OTT market entry illustrates the revenue multiplication potential. An operator initially focused on traditional IPTV delivery can leverage existing encoder hardware to launch internet-delivered services targeting cord-cutters and mobile viewers. This market expansion occurs without proportional infrastructure cost increases—the same encoder hardware that serves traditional subscribers simultaneously enables new revenue channels.

Enterprise and hospitality markets represent high-value verticals with specific technical requirements. Hotels require HDMI to IP encoder capabilities for in-room entertainment systems, corporate clients need secure private IPTV networks, and educational institutions demand reliable campus-wide video distribution. Hardware encoders with flexible output configurations serve these diverse requirements, allowing operators to pursue premium-priced enterprise contracts that cloud-based solutions often cannot accommodate due to latency, reliability, or integration constraints.

Geographic expansion becomes more economically viable with multi-format encoding. International markets exhibit varying bandwidth availability, device preferences, and regulatory requirements. Encoders capable of adaptive bitrate streaming and multiple codec support—including both H.264 encoder legacy compatibility and H.265 / HEVC encoding for bandwidth-constrained regions—enable efficient service delivery across diverse geographic conditions without market-specific infrastructure duplication. IPTV Encoder Box.

The strategic value compounds over time. As new streaming protocols emerge and device capabilities evolve, firmware-upgradeable hardware encoders adapt to support new formats. This future-proofing characteristic protects infrastructure investments and prevents the forced migrations that plague operators locked into proprietary or limited-capability encoding solutions.

Revenue impact measurement is direct: each new market segment accessed through existing encoder infrastructure represents incremental revenue against fixed costs. Operators report that multi-format capability enables 30-50% revenue growth within two years by serving previously inaccessible customer segments, all while maintaining lean operational overhead. IPTV Encoder Box.

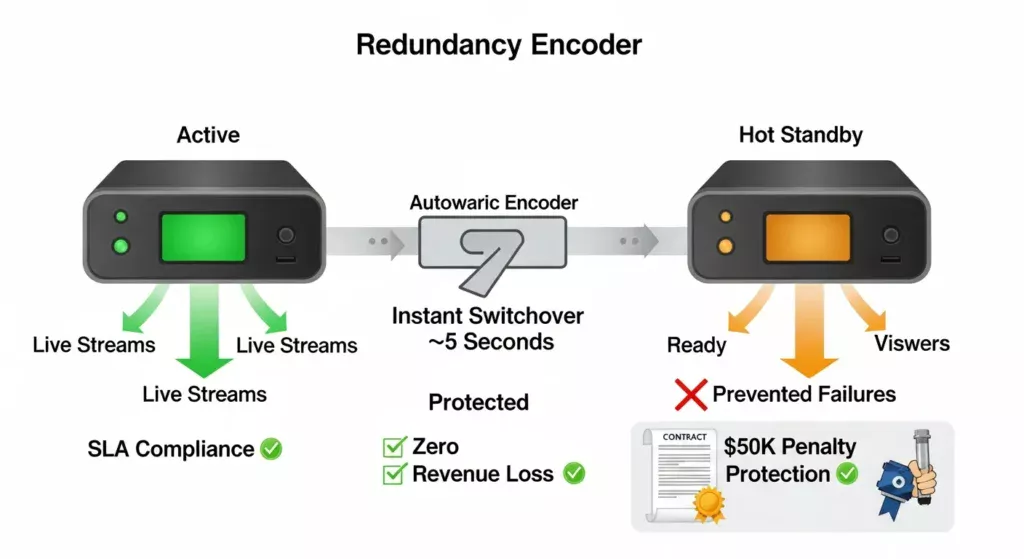

Encoder Redundancy and Failover as a Business Safeguard

Business continuity planning transforms from technical exercise to financial necessity when service interruption costs are measured in thousands per hour. Encoder redundancy and automated failover capabilities represent insurance policies against catastrophic revenue loss while protecting the contractual obligations that define professional IPTV operations.

Service level agreements with enterprise customers, hotel chains, and broadcast partners typically mandate 99.9% or higher uptime with financial penalties for violations. A single SLA breach can trigger penalty payments of $10,000-$50,000 depending on contract terms, plus provide customers with contract termination rights. Hardware encoder redundancy prevents these financially devastating scenarios through automatic failover systems that maintain service continuity during primary encoder failures. IPTV Encoder Box.

Redundancy architectures using IPTV Encoder Box hardware follow straightforward business logic. A secondary encoder operates in hot standby mode, continuously ready to assume encoding responsibilities if the primary unit fails. The incremental investment—typically the cost of one additional encoder—protects against revenue losses that could exceed the hardware cost within a single incident.

Customer retention benefits extend beyond immediate outage prevention. Subscribers increasingly expect Netflix-level reliability from all video services. Operators that deliver consistent uptime build trust and reduce churn, while those experiencing frequent disruptions face accelerating subscriber losses. Industry analysis indicates that operators with >99.5% uptime maintain annual churn below 8%, while those averaging 97% uptime experience 15-20% annual churn—a retention difference worth millions for medium-sized operations.

The redundancy investment also enables confident capacity planning. Operators can schedule maintenance, perform system upgrades, or replace aging components during low-traffic periods by switching to backup encoders without service interruption. This operational flexibility reduces the pressure for emergency overnight maintenance windows and minimizes the labor premiums associated with urgent technical work.

Insurance value provides another ROI perspective. Many operators maintain business interruption insurance to protect against revenue losses from equipment failures. Demonstrating robust redundancy and failover capabilities often qualifies for premium discounts of 15-25%, creating immediate cash flow benefits that partially offset redundancy infrastructure costs. IPTV Encoder Box.

Financial modeling reveals that redundancy justification requires preventing just one major outage annually. For operators generating $500,000 annual revenue, a six-hour prime-time outage costs approximately $3,500 in direct revenue plus customer service costs, refund processing, and reputation damage. A $10,000 redundancy investment pays for itself within three years through outage prevention alone—before considering SLA penalty avoidance, insurance savings, and customer retention benefits.

Operational Analytics and Performance Visibility

Data-driven decision making separates thriving IPTV operations from struggling ones. Modern IPTV encoder boxes with comprehensive monitoring and analytics capabilities provide the performance visibility that enables cost optimization, capacity planning, and revenue maximization strategies.

Real-time encoding metrics expose inefficiencies that silently drain profitability. Bitrate analysis across channels reveals over-provisioning scenarios where excessive quality settings consume bandwidth without proportional viewer satisfaction improvements. Operators commonly discover 20-30% bandwidth reduction opportunities by right-sizing encoding parameters—savings that compound across hundreds of channels and directly improve margins. IPTV Encoder Box.

Performance visibility also drives proactive maintenance scheduling. Encoder temperature monitoring, processing load trends, and error rate analytics predict component failures before they cause service disruptions. This predictive capability transforms maintenance from reactive crisis management into planned operational activities that minimize cost and prevent revenue-impacting outages.

Capacity forecasting becomes empirical rather than speculative when detailed encoder utilization data guides infrastructure planning. Historical performance trends reveal actual growth patterns, enabling operators to time encoder additions precisely when needed rather than over-investing in premature capacity or scrambling to address unexpected demand. This optimization typically reduces infrastructure costs by 15-25% compared to capacity planning based on rough estimates.

Viewer quality of experience metrics captured at the encoder level identify problems before they generate customer complaints. Buffering events, quality degradation episodes, and synchronization issues can be correlated with specific channels, time periods, or network conditions. These insights enable targeted improvements that enhance retention without broad infrastructure investments.

The analytics value extends to business development and pricing strategies. Understanding which channels consume the most encoding resources, which formats drive the highest engagement, and which quality tiers satisfy different customer segments informs product development and pricing optimization. Operators report that encoder-level analytics enable 10-20% revenue improvements through better service tier targeting and premium feature positioning. IPTV Encoder Box.

Competitive positioning benefits emerge from performance transparency. Operators can provide enterprise customers and partners with detailed uptime reports, quality metrics, and SLA compliance documentation—differentiators in markets where service reliability claims often exceed actual performance. This credibility enables premium pricing and reduces customer acquisition costs through reputation and reference value.

The ROI calculation for analytics-enabled encoders incorporates both cost savings and revenue enhancement. Bandwidth optimization alone typically generates annual savings of $5,000-$15,000 per encoder depending on channel count. Combined with improved retention, better capacity planning, and premium pricing capability, comprehensive analytics transforms the IPTV Encoder Box from passive infrastructure into an active profit optimization tool.

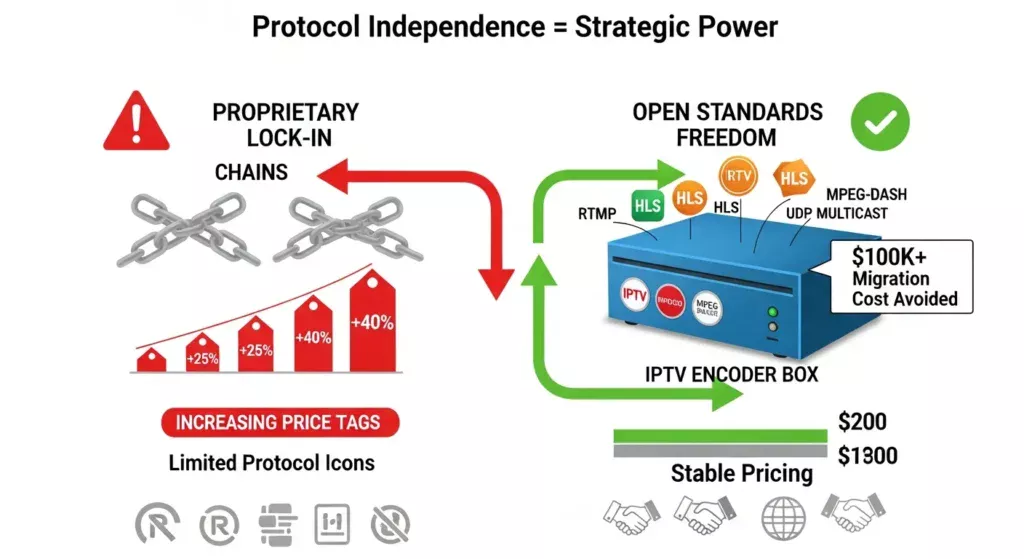

Vendor Lock-In vs Long-Term Flexibility

Strategic independence represents underappreciated but critical ROI factor in IPTV infrastructure decisions. Vendor lock-in scenarios create long-term cost vulnerabilities, limit negotiation leverage, and constrain the business model evolution that competitive markets demand. IPTV Encoder Box.

Proprietary encoding ecosystems trap operators in perpetual dependency relationships. Cloud encoding providers and closed-platform hardware vendors use protocol restrictions, format limitations, and integration incompatibilities to prevent customer migration. Once deeply committed to such platforms, operators lose pricing negotiation power and must accept whatever fee increases vendors impose. Industry examples include 25-40% price increases following vendor consolidations or market position changes.

Protocol and format independence provides strategic optionality. Hardware encoders supporting open standards—HTTP Live Streaming, MPEG-DASH, standard RTMP streaming implementations, and industry-standard UDP multicast streaming—enable operators to change middleware providers, CDN partners, or infrastructure vendors without forced encoder replacement. This flexibility maintains competitive leverage across the entire technology stack. IPTV Encoder Box.

The financial protection extends to content partnership negotiations. Media companies and content licensors increasingly specify delivery format and quality requirements. Operators locked into limited-capability encoding platforms may be excluded from valuable content partnerships or forced into expensive infrastructure parallel builds. Flexible multi-format encoders ensure no partnership opportunities are lost due to technical limitations.

Migration cost avoidance represents substantial value. Operators forced to replace proprietary encoding infrastructure face costs exceeding $100,000 for medium-scale deployments—including hardware, installation, testing, and operational disruption. Additionally, migration creates customer experience risks that threaten retention during transition periods. Avoiding these scenarios through vendor-neutral technology choices protects capital and operational stability. IPTV Encoder Box.

Negotiation leverage compounds over time. Operators demonstrating ability to migrate between technology providers receive superior pricing, service terms, and feature access from vendors competing to retain their business. This competitive dynamic creates value across the entire IPTV technology stack, not just encoding components.

Future business model flexibility depends on infrastructure adaptability. IPTV markets continue rapid evolution—new device categories, emerging delivery protocols, shifting consumer preferences. Hardware encoders with extensive format support and firmware upgrade paths enable operators to pursue new opportunities without infrastructure constraints. Proprietary platforms often force painful choices between pursuing new markets and protecting existing infrastructure investments. IPTV Encoder Box.

The long-term ROI advantage of vendor-neutral IPTV Encoder Box selection manifests across multiple dimensions: price protection through maintained competitive leverage, partnership access through format flexibility, migration cost avoidance, and strategic freedom to evolve business models as markets change. While difficult to quantify precisely, these benefits typically justify 20-30% premium pricing for truly open-platform encoding solutions.

Lifecycle Value, Depreciation, and Upgrade Planning

Strategic asset management extends IPTV encoder ROI beyond initial deployment through optimized lifecycle planning, tax-efficient depreciation, and coordinated upgrade timing that aligns technology refreshes with business growth phases. IPTV Encoder Box.

Professional-grade encoding hardware typically delivers 5-7 years of productive service life, though technological advancement and capacity requirements often drive replacement at the 4-5 year mark. Understanding this lifecycle enables operators to plan depreciation schedules that maximize tax advantages while maintaining performance currency. IPTV Encoder Box.

Depreciation planning under typical tax frameworks allows three to five-year accelerated depreciation schedules for broadcast equipment. A $12,000 encoder investment generates approximately $2,400 annual depreciation expense, reducing taxable income and improving cash flow. Over five years, the tax benefit at typical corporate rates returns 20-25% of the original investment value through reduced tax liability.

Upgrade timing aligned with business inflection points maximizes capital efficiency. Rather than reactive equipment replacement when failures occur, strategic operators plan encoder refreshes to coincide with major capacity expansions, new market entries, or technology transitions like the H.264 to H.265 / HEVC encoding migration. This coordination ensures new hardware investment directly enables revenue growth rather than merely maintaining existing capability. IPTV Encoder Box.

Technology refresh strategies also consider residual value. Quality hardware encoders maintain secondary market value that offsets upgrade costs. Operators commonly recover 30-40% of original investment when selling 3-4 year old equipment to smaller operators or secondary markets. This value recovery effectively reduces the net cost of technology currency maintenance.

Service disruption minimization during upgrades protects revenue continuity. Operators with proper redundancy and failover architectures can integrate new encoders gradually, running parallel systems during transition periods to ensure zero customer impact. This operational flexibility transforms potentially revenue-threatening migrations into controlled technology improvements. IPTV Encoder Box.

Capacity scaling flexibility provides another lifecycle value dimension. Modular encoding infrastructure allows operators to add encoding capacity incrementally as subscriber counts grow, rather than forced major investments triggered by platform limitations. This granular scalability optimizes capital deployment and prevents over-investment in premature capacity. IPTV Encoder Box.

Financial modeling incorporating full lifecycle economics reveals superior ROI for quality hardware investments. While budget-tier encoders may offer lower entry costs, their shorter service lives, limited upgrade paths, and minimal residual value create higher total cost of ownership. Premium broadcast-grade encoding equipment with longer productive lifecycles and better depreciation characteristics typically delivers 30-50% better five-year ROI despite higher initial pricing. IPTV Encoder Box.

The strategic approach to encoder lifecycle management treats these assets as evolving investments rather than static purchases. Operators develop multi-year technology roadmaps that coordinate encoder refreshes with business growth, tax planning, and market opportunity timing—transforming infrastructure management from reactive maintenance into proactive business strategy. IPTV Encoder Box.

Conclusion

The IPTV Encoder Box represents far more than technical infrastructure—it functions as a strategic business asset that directly influences profitability, operational resilience, and competitive positioning. From capital efficiency and latency-driven monetization advantages to reliability protection and strategic independence, the nine profit-boosting dimensions examined demonstrate how encoding infrastructure decisions ripple throughout IPTV business economics.

Operators who approach encoder selection through pure ROI analysis—incorporating uptime value, market expansion capability, vendor independence, and lifecycle optimization—position their businesses for sustainable growth in increasingly competitive streaming markets. The right hardware investment today creates compounding advantages that drive profitability for years while maintaining the flexibility to evolve as markets change. IPTV Encoder Box.

Smart infrastructure investment begins with recognizing that encoder economics extend far beyond initial purchase price to encompass total business impact across revenue, costs, and strategic optionality.

FAQs

Q1: How does an IPTV Encoder Box directly affect IPTV profitability?

A1: An IPTV Encoder Box impacts profitability through multiple channels: reducing per-channel bandwidth costs via efficient video compression, minimizing revenue-destroying downtime through superior reliability, enabling premium monetization like sports betting through low-latency performance, and providing multi-format capabilities that allow market expansion without parallel infrastructure investments. Quality hardware encoders typically generate ROI through cost savings and revenue enablement within 18-24 months. IPTV Encoder Box.

Q2: Is hardware encoding more cost-effective than cloud encoding long-term?

A2: Yes, for most established operators. While cloud encoding minimizes upfront investment, perpetual subscription costs typically exceed hardware encoder investment within 18-24 months. Over a five-year period, dedicated hardware encoding saves 60-70% compared to cloud solutions when factoring in subscription costs, bandwidth savings from superior compression, and elimination of per-channel usage fees. Hardware ownership also protects against vendor price increases that commonly affect cloud services. IPTV Encoder Box.

Q3: Can encoder reliability impact IPTV customer retention?

A3: Absolutely. Industry data shows operators maintaining >99.5% uptime experience annual churn rates below 8%, while those averaging 97% uptime face 15-20% churn—a retention difference worth millions for medium-sized operations. Each streaming quality issue drives 60% of viewers to abandon sessions, with 40% never returning. Hardware encoder reliability directly protects the consistent viewing experience that builds subscriber loyalty and reduces costly customer acquisition requirements. IPTV Encoder Box.

Q4: How often should IPTV encoder hardware be upgraded?

A4: Strategic upgrade timing typically occurs every 4-5 years, aligned with business growth phases, technology transitions, or depreciation completion. Professional-grade encoders deliver 5-7 years of productive service life, but technological advances—particularly codec evolution from H.264 to H.265/HEVC and beyond—often justify earlier refresh. The optimal approach coordinates upgrades with capacity expansions or new market entries, ensuring technology investments directly enable revenue growth rather than merely maintaining existing capability. IPTV Encoder Box.